Analysts from UBS and Citigroup, two of the world’s largest investment banks, believe the growth of solar power, in combination with advances in batteries and electric cars, will cause a huge disruption in the energy industry. UBS believes centralised fossil fuel generation will become “extinct” sooner than most people realise. Citigroup predicts renewables will replace coal and gas in power generation, which will free up the use of gas as a substitute for oil in transport. Giles Parkinson of the Australian website Reneweconomy.com.au has the story.

Leading investment bank UBS says the payback time for unsubsidised investment in electric vehicles plus rooftop solar plus battery storage will be as low as 6-8 years by 2020 – triggering a massive revolution in the energy industry.

“It’s time to join the revolution,” UBS says in a note to clients, in what could be interpreted as a massive slap-down to those governments and corporates who believe that centralised fossil fuel generation will dominate for decades to come.

UBS, however, argues that solar panels and batteries will be disruptive technologies. So, too, will electric vehicles and storage.

By the end of the decade, it says, the combination of will deliver a pay-back time of between six to 8 years, as this graph below shows. It will fall to around 3 years by 2030. Right now, the payback is probably around 12 years, enough to encourage the interest of early adopters. You can read more here on Why EVs will make solar viable without subsidies.

The UBS report is focused on Europe, where it says that Germany, Spain, and Italy will be leaders because of their high electricity and fuel costs. But it could equally apply to Australia, which has both high electricity and high fuel costs, and a lot more sun – so solar is much cheaper.

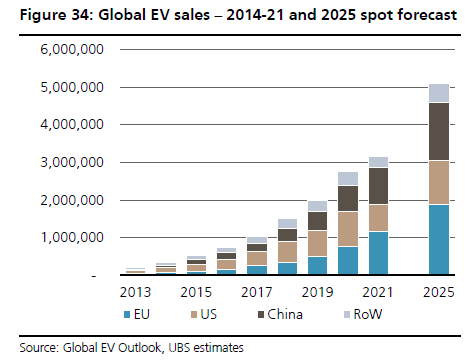

UBS forecasts that EVs and plug-in hybrid will account for around 10 per cent of the market in Europe by 2025. “While the initial growth should predominantly be driven by incentives and carbon regulation, the entry into the mass market should happen because EVs will pay off,” it says.

“The expected rapid decline in battery cost by (more than) 50 per cent by 2020 should not just spur EV sales, but also lead to exponential growth in demand for stationary batteries to store excess power. This is relevant for an electricity mix with a much higher share of (volatile) renewables.”

In this decentralised electricity world, UBS says, the key utilities’ assets will be smart distribution networks, end customer relationships and small-scale backup units.

Those utilities that are able to move with the times – and the technologies – should be able to extract more value in (highly competitive) supply activities, as customer needs will be more complex.

Those that favour the past face impending doom.

“Large-scale power generation, however, will be the dinosaur of the future energy system: Too big, too inflexible, not even relevant for backup power in the long run,” UBS writes.

Timing

The timing of the report is noteworthy, given that what used to be Australia’s cleanest and greenest energy utility, AGL Energy, on Wednesday doubled its bet on coal remaining the dominant fuel in a centralised system. The Abbott government, meanwhile, is betting the whole Australian economy on a similar assumption.

UBS says centralised fossil fuel generation will become “extinct” – and it will happen a lot sooner than most people realise.

“Our view is that the ‘we have done it like this for a century’ value chain in developed electricity markets will be turned upside down within the next 10-20 years, driven by solar and batteries.”

In this decentralised electricity world, the key utilities’ assets will be smart distribution networks, end customer relationships and small-scale backup units

As a virtuous circle, lower battery cost will also spur EV sales, which should bring further economies of scale to batteries, also for stationary applications. Power is no longer something that is exclusively produced by huge, centralised units owned by large utilities.”

“By 2025, everybody will be able to produce and store power. And it will be green and cost competitive, i.e., not more expensive or even cheaper than buying power from utilities. It is also the most efficient way to produce power where it is consumed, because transmission losses will be minimised. Power will no longer be something that is consumed in a ‘dumb’ way. Homes and grids will be smart, aligning the demand profile with supply from (volatile) renewables.”

This will put enormous pressure on utilities and centralised generators.

“The closer utilities are to the electricity user (both residential and commercial/industrial), the better they should fare in a decentralised electricity system,” the analysts write. “We think large-scale power plants are the structural losers from this trend, as they are too big and most of them are too inflexible. ”

UBS predicts that most large scale centralised plants could be gone within a decade. “Not all of them will have disappeared by 2025, but we would be bold enough to say that most of those plants retiring in the future will not be replaced.” And it torpedoes the theory that the retirement of some more expensive plants (the merit order effect) will cause a rebound in wholesale prices. “The last survivors will be the low-marginal-cost plants ,” it says. “We believe that what is perceived as an ‘optionality’ in conventional power generation by some investors will never materialise. Large-scale power stations could be on a path to extinction.”

Citigroup: bright outlook for solar is getting brighter

Meanwhile, UBS’s colleagues at Citigroup have produced a report that paints an incredibly bright future for solar energy across the globe, arguing that its rapid expansion will be driven by “pure economics” and the growing need for diversity.

“We believe global solar growth will be driven by economics, fuel diversity and emerging financing vehicles as well as some country specific legislative overlay,” Citi analysts argue in a new report.

“Moreover, this growth looks set to continue for the long term, as solar takes an ever greater share of energy generation, helped by improving economics against fossil fuels.”

The report, Energy 2020: The Revolution Will Not Be Televised as Disruptors Multiply, cites a bunch of key reasons why the outlook for solar energy is so positive.

This includes significant improvements in solar efficiency and the cost of capital, continuing falls in the cost of manufacturing, the reaching of residential grid parity in many more countries (even the UK as early as 2018), and the need to diversify and hedge against fossil fuel price volatility and security risks.

This latter point is significant. Citi says that many of the US utilities it has surveyed have highlighted the need to diversify into other generation sources to hedge against a change in the current low gas price environment.

Shale gas may have created a short term surplus and lower gas prices, but no one is betting that this will remain the case, which is why many are already choosing solar over gas in new generation projects, particularly in the US south-west.

“So besides pure economics, from a utility perspective, the need to diversify is crucial to remove the volatility and possible upward movement in gas prices over the longer term,” Citi notes.

Global support driven by new and old

Citi notes that solar is not a one of several country phenomenon. Growth will come from established markets such as China, Japan, US and UK, and emerging markets in India, Latin America, and the Middle East.

It dismisses forecasts by the International Energy Agency – which predicts 662GW of solar by 2035 and $1.3 trillion of investment – as “highly conservative”.

Shale gas may have created a short term surplus and lower gas prices, but no one is betting that this will remain the case

“High electricity rates and some of the best solar economics in the world (i.e. Latin America) coupled with a need to diversify into other fuel mixes should translate into substantial growth opportunities over the next few years.”

It notes that solar has reached socket (residential) parity in many global regions at the residential level, with more to come – the UK as early as 2018, Japan between 2014 and 2016, and South Korea between 2016 and 2020.

And it says that utility-scale parity is also expected over the next few years.

“For economics, look at the levelised cost of electricity (LCOE) – a key metric of comparing various energy sources. We believe globally, solar will become increasingly competitive with natural gas peaking plants and CCGTs as LCOE trends downward over the long-term and regulators and policy encourages fuel diversity.”

Citi says that the lower solar LCOE is driven by lower financing costs and improved solar efficiencies while natural gas prices continue to increase.

Lower capital costs for solar

One of the biggest factors governing the cost of any technology is the capital outlay. Nuclear, because of the horrendous risk, pays huge amounts of capital. Solar – because it is relatively new technology at commercial scale – faced similarly prohibitive financing, but this is rapidly changing as financial instruments attract large licks of capital from mainstream investors and financiers.

In the US, the cost of equity is being lowered by the emergence of “YieldCos” – a tax efficient structure that creates dividend growth for equity investors. With reduced equity costs, buyers of contracted solar assets are able to pay for these with 7-10 per cent IRRs on equity in current market conditions.

The cost of debt is also falling. As the size of the solar industry continues to grow, the financing market is beginning to mature. An asset backed securities market has formed for solar which lowers interest rates on debt as it taps a large investor universe that can derive more value out of cash flow than traditional debt investors.

In the last year, the industry has priced debt below 5 per cent blended interest rate. In addition, traditional lenders are assuming lower risk profiles for the assets as the associate cash flows are better understood and viewed to be less risky.

Along with these developments, Citi says the industry continues to make meaningful advances in financial and tax structures to create stability in cash flow for renewable assets. These innovations have improved the ability of residential, commercial, industrial, and utility customers to develop the systems.

“Once developed, certain companies have structured vehicles to efficiently transfer cash flow between jurisdiction and ultimately their shareholders. These developments, coupled with lower debt and equity costs is making solar more affordable and increasing demand for solar power.”

Increases in manufacturing efficiencies

Citi notes that while key input costs for manufacturing of solar modules have held relatively constant after a period of rapid decline due to industry over-capacity, the outlook is attractive.

Large solar developers and manufacturers such as First Solar, SunPower, and SolarCity are now expecting efficiencies to improve materially in the next few years as technology matures, investments in manufacturing continue, and volume growth enables lower per unit costs.

Citigroup dismisses forecasts by the International Energy Agency – which predicts 662GW of solar by 2035 and $1.3 trillion of investment – as “highly conservative”

“The outlook for solar LCOE is favorable but the devil is in the details,” says the Citi report. “The system costs are comprised of module costs plus balance of systems (BOS). System costs vary based on end user, location, and other factors. The raw input prices (poly, ingot, wafer, cell) are subject to global markets and an industry learning curve while BOS costs are more specific to location. Insolation and solar inefficiencies are driven by location specifics and technological advancements.”

“Solar LCOE is also sensitive to secondary inputs such as module lifespan, opex, and degradation. Of these components, the largest gains are expected in greater solar efficiency levels. With an attractive cost decline curve, there are several competing solar technology including PV, CadTel, CSP (concentrated solar power), and storage investments that are competing to serve the market.”

Solar in the broader energy revolution

The broader context is also significant. Citi identifies solar as one of several key trends in the global energy market – the fact that the shale revolution is spreading from its North American birthplace; that inter-fuel substitution is breaking new ground (replacement of coal and gas generation by renewables, and replacement of oil by gas in transport); that renewables are becoming viable without subsidies; and that inter-regional energy trade is being transformed.

“All of these seemingly disparate trends can be pulled into one overarching thesis,” Citi says. “The shale revolution represents a step change in terms of supply, while inter-fuel substitution transforms the demand side of the equation; renewables replace coal and gas in power generation and this frees up natural gas to substitute for oil in transportation.”

source: http://www.energypost.eu/ubs-citigroup-warn-investors-massive-revolution-energy-industry/

Comments are closed.